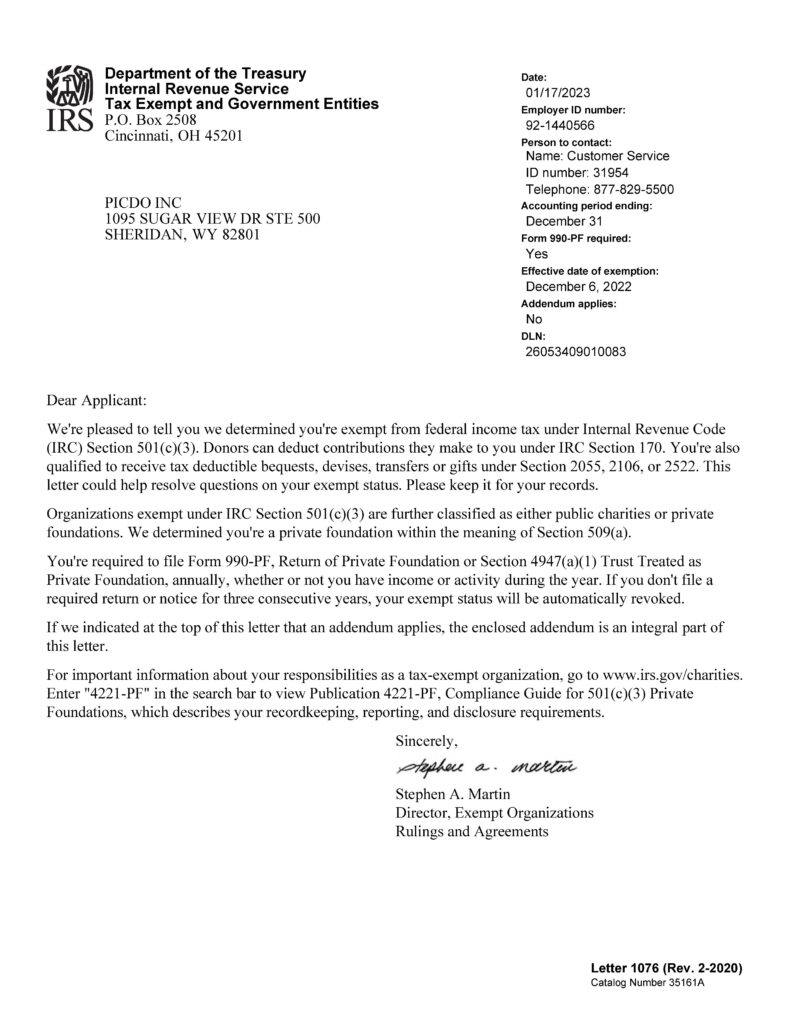

On January 17, 2023, The US Internal Revenue Service determined that PICDO is exempt from federal income tax under Internal Revenue Code (IRC) Section 501(c)(3). Donors can deduct contributions they make to you under IRC Section 170. PICDO is also qualified to receive tax deductible bequests, devises, transfers or gifts under Section 2055, 2106, or 2522. This letter depicted below will help resolve questions on our exempt status.

Organizations exempt under IRC Section 501(c)(3) are further classified as either public charities or private foundations. The IRS determined that PICDO is a private foundation within the meaning of Section 509(a).